Our Investment Philosophy | The Bucket Approach

Financial Edge Group’s Investment Philosophy utilises the ‘Bucket Approach’ when structuring retiree portfolios.

At its core, this strategy allows retirees to manage the risks associated with ‘sequencing risk’, which refers to the impact that financial market volatility can have on the timing of withdrawals from an investment portfolio.

Whilst volatility does not always mean that financial markets are moving down, we view the risk of ignoring the potential for a market downturn to affect our clients’ retirement plans as unacceptable. The reason for this is simple – we want our clients to be able to sleep at night, knowing that the next several years cashflow is taken care of, no matter what is happening in the financial markets.

So, how do we achieve this? Well, as mentioned, we use a 3 bucket approach to investing client funds:

Bucket 1: Cash

The first bucket should contain cash, with the equivalent of 1 year of retirement living costs. This ensures that our clients have easy access to cash to cover day-to-day expenses, with no investment risk.

Bucket 2: Fixed Income

The second contains the equivalent of 2-5 years of retirement living costs and is invested in ‘fixed income’ investments. This can include investments such as term deposits and bonds. Naturally, these investments are not risk free, but they do carry a much lesser risk than growth assets. Therefore, as investors, we expect to be rewarded with a higher yield than the cash, whilst still providing retirees with a steady stream of income to support their lifestyle.

Bucket 3: Growth

This bucket contains growth investments, such as shares, property and other alternative investments with a growth focus. This is the part of the portfolio which comes with the most volatility, however it is also the powerhouse of the overall portfolio, ensuring that your money lasts as long as you do and, more importantly, will support your retirement goals.

However, as investors we must accept that greater returns comes with greater volatility. Hence the reason for the above two buckets.

That sounds great, but where does the figure for 5 years’ worth of retirement living costs in Buckets 1 and 2 come from?

We base the structure of our bucket approach on historical market data, and what we’ve found is that setting aside 5 years’ worth of retirement living costs protects against sequencing risk that can be so detrimental to a retirees plans.

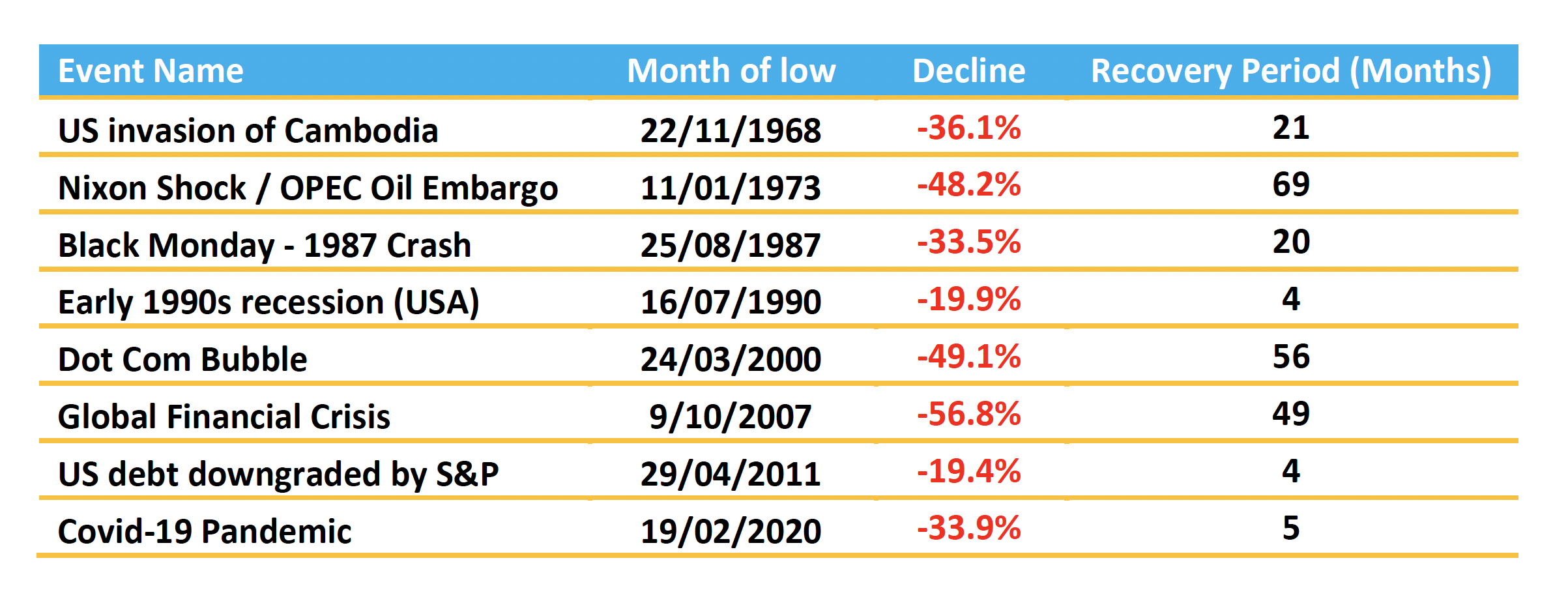

Below we summarise some of the worst financial crisis in history and outline how long it took growth focused portfolios to recover following these events:

As the above table shows, there have been many bear markets over the past 50 years, with various length and declines and all but one of these recover within 5 years and the average recovery is 19 months.

Therefore, by structuring portfolios in this way, we can maintain certainty about cashflow during retirement whilst allowing bucket 3 ride out waves in the financial markets, only drawing upon it to top up buckets 1 and 2 when economic times are good.